Astoria Portfolio Advisors

New York, NY 10018

Mobile: +1 (917) 862-1995

Articles by Astoria Portfolio Advisors

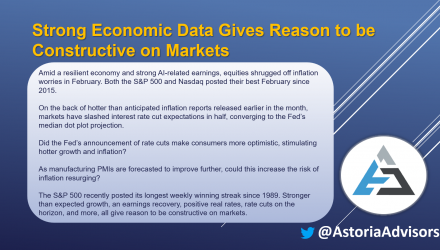

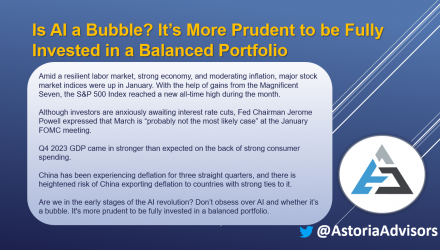

Stocks Will Need to Deliver on Earnings, but Remember, the Fed Has Rate Cuts in Its Back Pocket

Equity Markets Post Worst Month of 2024 Amid hotter inflation, hawkish Fed commentary, and geopolitical tensions, all three major stock…

John DaviCEO and CIO

Astoria's founder, John Davi, is an award-winning research strategist and has over 20 years of experience spanning across Macro ETF Strategy, Quantitative Research, and Portfolio Construction. Before starting Astoria, he was the head of Morgan Stanley's Institutional ETF Content and advised many of the world's largest hedge funds and asset managers on ETF portfolio construction. John published hundreds of reports in his research career across a variety of topics from ETFs, indices, futures, and structured products.

John began his career in 2000 doing research on ETFs in Merrill Lynch's Global Equity Derivatives Research group. John structured ETF portfolio solutions as early as 2002 for Merrill Lynch's client base where several billion in assets were raised and executed. John's research has been recognized and featured on ETF.com, ETFTrends.com, InsideETFs, Institutional Investor Magazine, and he is a regular contributor to CNBC, Bloomberg, and other media outlets. He was recognized by Bloomberg as an "ETF Master Chef."

Astoria's founder, John Davi, is an award-winning research strategist and has over 20 years of experience spanning across Macro ETF Strategy, Quantitative Research, and Portfolio Construction. Before starting Astoria, he was the head of Morgan Stanley's Institutional ETF Content and advised many of the world's largest hedge funds and asset managers on ETF portfolio construction. John published hundreds of reports in his research career across a variety of topics from ETFs, indices, futures, and structured products.

John began his career in 2000 doing research on ETFs in Merrill Lynch's Global Equity Derivatives Research group. John structured ETF portfolio solutions as early as 2002 for Merrill Lynch's client base where several billion in assets were raised and executed. John's research has been recognized and featured on ETF.com, ETFTrends.com, InsideETFs, Institutional Investor Magazine, and he is a regular contributor to CNBC, Bloomberg, and other media outlets. He was recognized by Bloomberg as an "ETF Master Chef."

David ClarkPresident and Head of Business Development

David Clark is President and Head of Business Development for Astoria Portfolio Advisors LLC. He has more than 25 years of experience in the financial services industry. David spent the first 18 years of his career at Merrill Lynch (subsequently Bank of America), holding various institutional sales management and business development leadership roles in London and New York. David was Head of Merrill’s European Convertible Bond, Equity Derivative, ETF and Delta One sales, and sat on the firm’s European Markets Operating Committee. He also served as Head of B of A’s Americas International Derivative and Swap sales. Additionally, David was Head of Americas Global Delta One, ETF and Stock Loan Distribution and Product, and a member of the North American Equity Sales Operating Committee. He later spent six years at Société Générale, where he was head of U.S. Sales for Global Securities Financing, overseeing distribution of ETF, Swap and Structured Financing products. David graduated from Villanova University with a Bachelor of Arts degree in Economics, and currently sits on the school’s President’s Advisory Council. He lives in Chatham, New Jersey with his wife and three children.

Bruce Lavine,

CFASenior Strategy Advisor

Bruce Lavine is a Senior Strategy Advisor of Astoria Portfolio Advisors LLC. Bruce has a long history in the ETF and asset management business beginning with Barclays Global Investors over 20 years ago. He was one of the earliest employees at iShares and had roles including CFO, Head of Product Development and CEO of iShares Europe. In 2006, Bruce joined WisdomTree as President and Chief Operating Officer. He was there for 10 years as an employee and remains active with WisdomTree today as a member of their Board of Directors. Most recently, Bruce was the CEO of 55 Capital. Bruce has an MBA and BS both from the University of Virginia and he is a Chartered Financial Analyst.

Gregory SandersonDirector of Sales

Gregory Sanderson is Director of Sales for Astoria Portfolio Advisors LLC. He has more than 15 years of experience in the financial industry. Gregory began his career as a specialist clerk on the American Stock Exchange. He has worked for several investment banks including Credit Lyonnais and JP Morgan, always in a trading capacity. Over the course of his career, he has worked with many different financial products including equity, bonds, credit default swaps, and collateralized loan obligations. Gregory is a graduate of Fordham University.

Gregory Sanderson is Director of Sales for Astoria Portfolio Advisors LLC. He has more than 15 years of experience in the financial industry. Gregory began his career as a specialist clerk on the American Stock Exchange. He has worked for several investment banks including Credit Lyonnais and JP Morgan, always in a trading capacity. Over the course of his career, he has worked with many different financial products including equity, bonds, credit default swaps, and collateralized loan obligations. Gregory is a graduate of Fordham University.

Michael Stulic,

CFA, FRM, PRMDirector of Capital Markets

Michael Stulic is the Director of Capital Markets for Astoria Portfolio Advisors. Within this capacity, he oversees all trading execution and front-to-back client account management. Michael brings over 20 years of experience within the financial industry and sell-side banking. His banking experience, largely within bulge bracket firms, consists of JPMorgan, Deutsche Bank, Credit Suisse, and Barclays. Having worked within Credit Derivatives, Emerging Markets, and Correlation trading along with more recent risk management experience within the liquidity, capital, and contingent liability risk stripes, Michael brings a diversified background and unique perspective to the firm.

Michael has achieved several notable designations over his career, consisting of the Chartered Financial Analyst (CFA), Financial Risk Manager (FRM), and Professional Risk Manager (PRM) designations. He is a graduate of Binghamton University with Bachelor of Science degrees in both Economics and Chemistry.

Nick Cerbone,

CFAVice President, Quantitative Strategy

Nick Cerbone serves as a Quantitative Strategist for Astoria Portfolio Advisors LLC. In this capacity, Nick assists in all aspects of portfolio construction and optimization of our cross-asset ETF portfolios. Nick is a Summa Cum Laude graduate of Hofstra University with a Bachelor of Science degree in Mathematical Finance.

Frank Tedesco IIIAnalyst

As an Analyst at Astoria Advisors, Frank Tedesco contributes to both the sales and portfolio management teams, providing them with the perspective and understanding of the other. He works with high-net-worth clients and institutional investors, delivering customized solutions and strategies based on their goals and risk profiles.

Frank holds a BS in Finance from Fordham University's Gabelli School of Business, where he graduated magna cum laude and received multiple honors and certifications. Frank is passionate about helping clients achieve their financial objectives and grow their wealth.

More Articles

Important Risk Information

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA's express written consent.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce returns.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and have been licensed for use by State Street Global Advisors. S&P®, SPDR®, S&P 500®,US 500 and the 500 are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by State Street Global Advisors. The fund is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of these indices.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds' investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-800-242-0134 download a prospectus or summary prospectus now, or talk to your financial advisor. Read it carefully before investing.

Not FDIC Insured - No Bank Guarantee - May Lose Value.

© 2024 State Street Corporation. All Rights Reserved.

6585411.1.1.AM.RTL

MID001109

4/30/2025